Global markets are entering a new era in 2025, following three interest rate cuts by the U.S. Federal Reserve (FED) since September. In Turkey, the Central Bank also cut interest rates for the first time in 22 months on December 26, and further rate reductions are expected in 2025. This decline in interest rates is anticipated to positively impact the investment climate, ushering in a shift from short-term to long-term investments.

Even during the high-interest-rate environment, long-term investments—particularly in alternative investment funds (AIFs)—continued to grow. With the transition to a lower rate environment, expectations are rising for accelerated growth in the AIF market in 2025.

In Turkey, alternative investment vehicles include venture capital investment funds (VCIFs) and real estate investment funds (REIFs). RePie Asset Management, the market leader with approximately a 22% share in both portfolio size and number of issued funds, continues to lead the industry. Dr. M. Emre Çamlıbel, Chairman of the Board at RePie Asset Management, emphasized that the growth of AIFs in Turkey significantly outpaces the global average.

Global AIF Market Heading Towards $30 Trillion

"Faced with high inflation and market volatility, investors have diversified their portfolios—traditionally composed of stocks, bonds, and precious metals—by turning to alternative investment instruments," said Çamlıbel. "The global AIF market is expected to grow by 5% this year, reaching approximately $23.21 trillion. By 2030, this figure is projected to reach $30 trillion. In contrast, the Turkish AIF market grew by an impressive 89% in 2024, reaching 388 billion TL. With ongoing rate cuts, we anticipate even faster growth, surpassing 500 billion TL in 2025."

According to Çamlıbel, the total value of VCIFs in Turkey rose by 86% in 2024 to 240.7 billion TL, while REIFs increased by 95%, reaching 148.2 billion TL.

Growing Interest from Institutional and Individual Investors

Highlighting that institutional investors globally allocate around 35% of their portfolios to alternative investments, Çamlıbel added:

"In Turkey, pension funds are the leading institutional investors in AIFs. Research shows that a portfolio balanced with alternative investments consistently outperforms traditional portfolios. As a result, individual investors are increasingly turning to AIFs. In 2024, the number of qualified individual investors in AIFs rose by 26%."

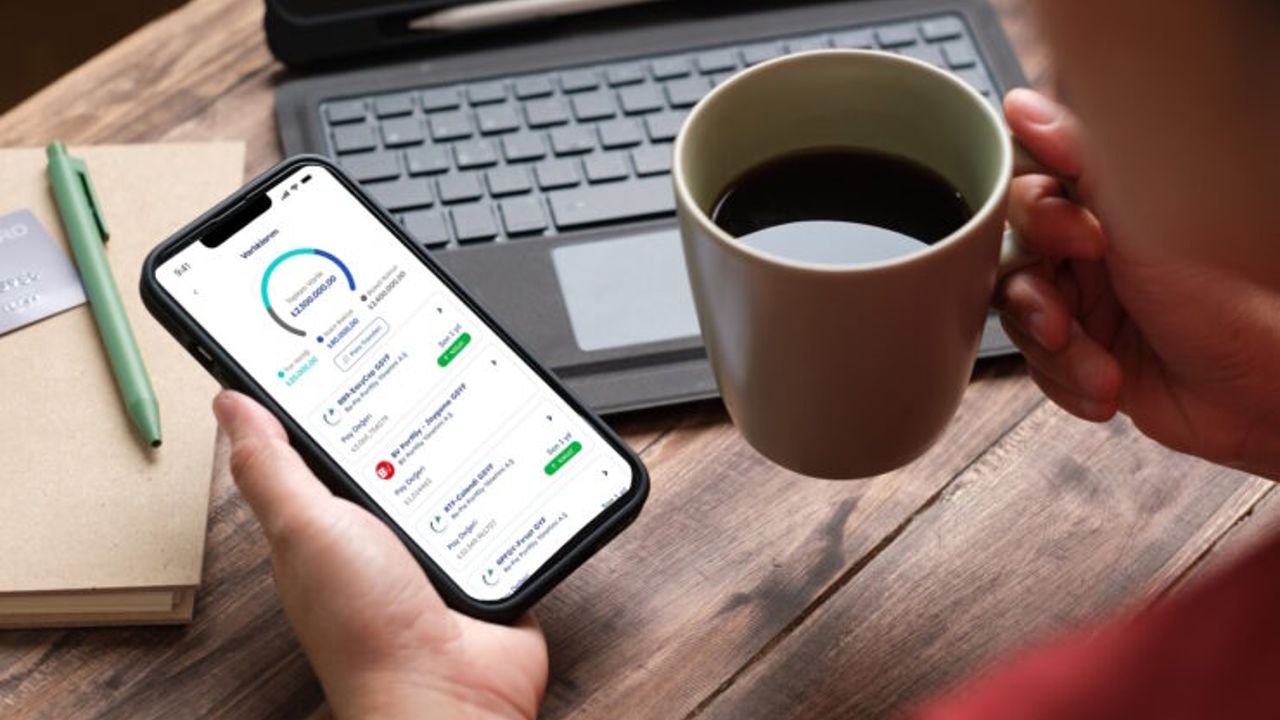

RePie's 2025 Portfolio Target: 150 Billion TL

As Turkey’s first and largest alternative asset manager, RePie Asset Management has maintained its leadership since its inception. In 2024, the company grew by 45%, reaching a total portfolio size of approximately 82 billion TL. It currently manages 44 VCIFs, 36 REIFs, 15 securities investment funds, and 2 pension funds.

In 2024, RePie made notable acquisitions, including 100% of Modanisa, a leading online fashion platform, and Doğan Burda, Turkey’s largest magazine publishing group. Its final investment of the year was in Goldtag, a platform enabling easy and secure access to precious metals and agricultural commodities.

Çamlıbel reaffirmed the company’s mission to broaden access to high-potential companies and real estate projects for investors:

"Our goal is to expand our portfolio to 150 billion TL by the end of 2025, including investments in some of Turkey’s most promising unicorn candidates."

New Funds on the Way

Looking ahead to 2025, Çamlıbel stated:

"We are entering a year rich in pre-acquisition, pre-IPO, and M&A activity. VCIFs offering pre-IPO opportunities will provide investors with early access. We will continue to diversify the investment opportunities we offer across all fund categories."

He also noted that new regulations in 2024 paved the way for project-based real estate investment funds (Project REIFs):

"We believe this new structure will contribute significantly to both the sector and the broader economy by improving housing accessibility. Leveraging our experience in the real sector, we plan to issue Project REIFs in 2025 to offer new options for our investors."

Çamlıbel also mentioned the planned removal of the short-selling ban on the stock exchange in January:

"We expect this will enable arbitrage returns to match interest rates. Following the removal of the ban, we will launch our arbitrage fund, which aims to deliver enhanced returns through leverage."

Expanding Strategic Partnerships with Industry Leaders

RePie Asset Management, with over 10 years of experience in alternative investments, continues to apply its expertise in the field of corporate venture capital. The firm plans to expand its institutional portfolio in 2025.

"In addition to AIFs, we have also grown significantly in securities investment funds and private wealth management this year," Çamlıbel said.

"We’ve long partnered with major players in the sector. Companies that leverage RePie's experience and industry know-how are able to reduce operational burden and focus more effectively on their strategic goals. In 2025, we will be announcing new partnerships in this area."